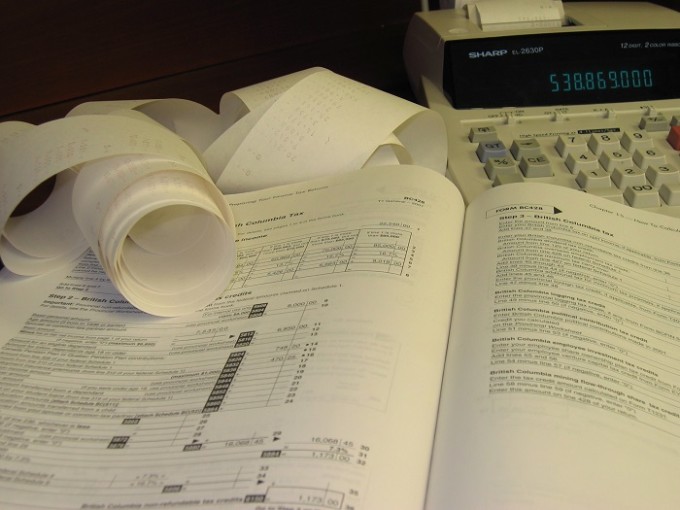

Have you filed your taxes yet? According to the Internal Revenue Service, an estimate of $147 billion in refunds has been sent out over the past four weeks with the average tax refund being $3,034! If you happen to be included among these statistics and received a nice chunk of dough you might already be planning on how to spend your tax refund. Now you could follow most Americans who plan on banking the cash, but what fun is there in that? Spending the money wisely could actually free up some of your paycheck throughout the year.

I have come up with 5 smart (or what I believe are smart) and responsible suggestions on how to spend your tax refund and make the most of your hard-earned tax cash.

5 Ways on How to Spend Your Tax Refund

1. Pay off Credit Card Debt: Gather all your credit card statements and look for the credit card that charges the highest interest rate, and pay it off. If the debt is too high, then pay off the credit card with the lowest balance first. Take the money you were using to pay for the debt and concentrate on paying off the credit card with the highest interest rate. The extra money applied will help lower the balance quicker and save you money. Remember—the lower the balance the less you have to pay in interest.

2. Go Green : Perhaps you have an appliance in your home that is a dinosaur, such as an old refrigerator, clothes dryer, dishwasher, etc.? Appliances like refrigerators over 10 years old use more energy, which in return is bad for the environment and your wallet. By properly recycling your old refrigerator and replacing it with an Energy Star Certified model, you can expect to save approximately $200 to $1,100 on energy costs over the appliance’s lifetime. The extra money you save could go towards food to stock the new refrigerator. Check out Energystar.gov’s very cool Energy Star Savings Calculator to find out how much money you will save by replacing your current refrigerator.

3. Hit the Clearance Racks: This time of year retailers are having mad sales to catch some of your refund dollars. Head to the back of the store to the clearance racks and scoop up drastically reduced winter clothing for ¼ the cost you normally would pay. Plan ahead for your child’s cold weather wardrobe by purchasing clothes that are one size up from what they are wearing now. Stick to the staples such as jeans, sweaters, scarves, and gloves. The styles do not change too much from year to year for children’s’ clothing, thus you are able to stock up for hundreds of dollars less than if you were to buy in season. Additionally, watch for items that can be put away and used for Christmas gifts too!

4. Splurge on a Single Cup Coffee Brewer: Get your gourmet coffee fix in the comfort of your own home for a fraction of the cost you would pay at a café by purchasing a single serve brewer. For instance, a latte at Starbucks in New York costs about $4. So, if you get a single cup before going to work 5 days a week it is costing you $20. Times $20 by 52 weeks and you are paying over $1000 yearly for your coffee addiction! There are single serve coffee brewers on the market which can produce the same near yummy results in your kitchen for under a $1 a cup. Additionally, there are reusable single serve filter cups for single cup brewers like the Keurig allowing you to use your favorite coffee, so you can ditch the prepackaged K-cups , save even more money, and be a bit more eco-friendlier. Overall, you will be saving a mint year to year on coffee and the gas it takes to driving to a local café.

5. Get Fit at Home: Why waste money on an expensive gym membership when you are able to get the same results working out at home? If you need to shed a few pounds going to the gym might seem logical. But let’s face it, you are likely to feel self-conscious exercising in a public place and make all kinds of excuses not to go. Do your health and self a favor by purchasing a treadmill that you will feel comfortable walking on in your tight active wear. Fido (the dog) is not going to snicker at your extra roll hanging out and you are likely to exercise more often at home. Plus, the treadmill will pay for itself in many ways! Getting fit will save you in medical expenses, due to weight-related illnesses and once you shed the pounds you even might be eligible for lower insurance premiums! Invest in your health! You are worth it!

How do you plan on spending your tax refund?

I would love to know how you plan on spending your tax refund! Are you going to use it to go on vacation, bank it, or maybe update a room? Let me know in the comment section below!

Awesome Tax Season Deals!

Maybe all this tax and refund talk is making you stressed out, because you haven’t filed yet? Save money by taking advantage of the awesome Tax Season Deals going on right now and start dreaming about your refund! Get the best deals and coupon codes on tax software for everything from H&R Block to tax services like Jackson Hewitt!

Coupons.com Tax Season Sweepstakes

Check out the Coupons.com Tax Season Giveaway (begins Monday, March 17th 12:00am PT through April 15, 2014 11:59pm PT) for the chance to win daily cash prizes! But before you go, enter below for the chance to win a $100 Amazon.com Gift Card ! Please follow the instructions on the Rafflecopter Form to enter! Prize provided by Coupons.com. Good luck!

Giveaway ends March 31, 2014

[field name= iframe]

I WANT IT!

Those are 5 great tips. I have actually done the first two. Every year I sit down and figure out how many debts I can eliminate. I also would pay bills by the year with my income tax to save me money like my car insurance. They would give me a discount for paying for a year verses paying the bill buy the month or quarter. Plus by doing that I didn’t have to worry about being able to afford that monthly bill. I also found paying for life insurance premium was easier by paying it for the year and not having to worry about that added bill and the chance of it being canceled. With the economy so unstable to have your car insurance and life insurance paid for the year would be a big stress reliever if you were ever to be laid off from a job. As for number 3 I only shop clearance all year round so that’s a must do for sure and a great tip. No Starbucks around here so no worries on that money wasted for number 4 and I’ve never been to a gym and I really don’t think there is one around here either so no worries on number 5 but they both are great tips for those who do. Seriously $1000 for coffee a year, all I can say is wow.